missouri employer payroll tax calculator

Additions to Tax and Interest Calculator. Missouri tax year starts from July 01 the year before to June 30 the current year.

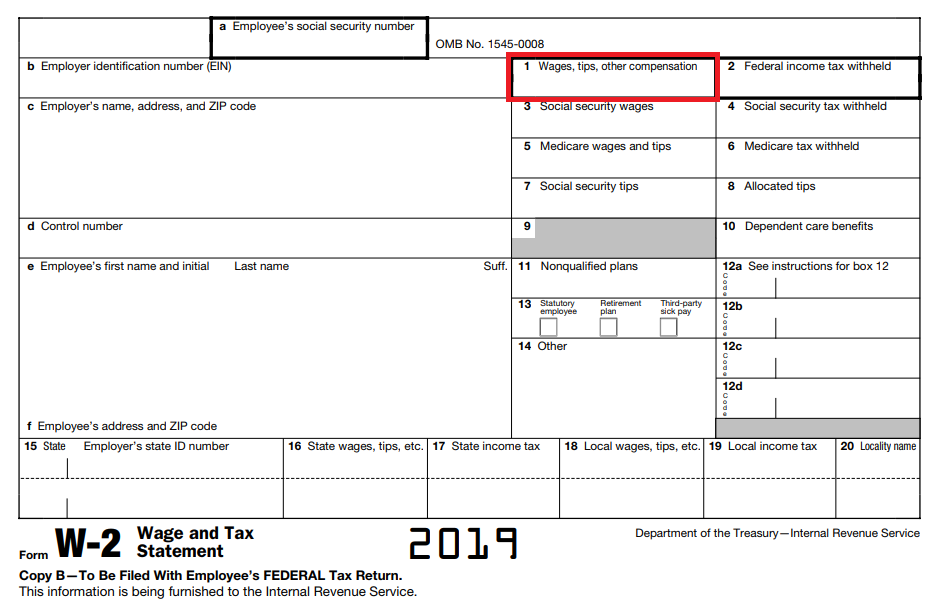

The withholding tax tables withholding formula MO W-4 Missouri Employers Tax Guide and withholding tax calculator have been updated.

. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The first step is to calculate the payroll tax in Missouri with the Missouri payroll tax calculator and apply the state tax rate to the earnings of all firms starting at 15. Employer Withholding Tax - Missouri The withholding tax tables withholding formula MO W-4 Missouri Employers Tax Guide and withholding tax calculator have been updated.

Brush up your resume sign up for training and create an online profile with. Employer tax in Georgia employee tax. Employees can use the calculator to do tax planning and project future withholdings and changes to their Missouri W-4.

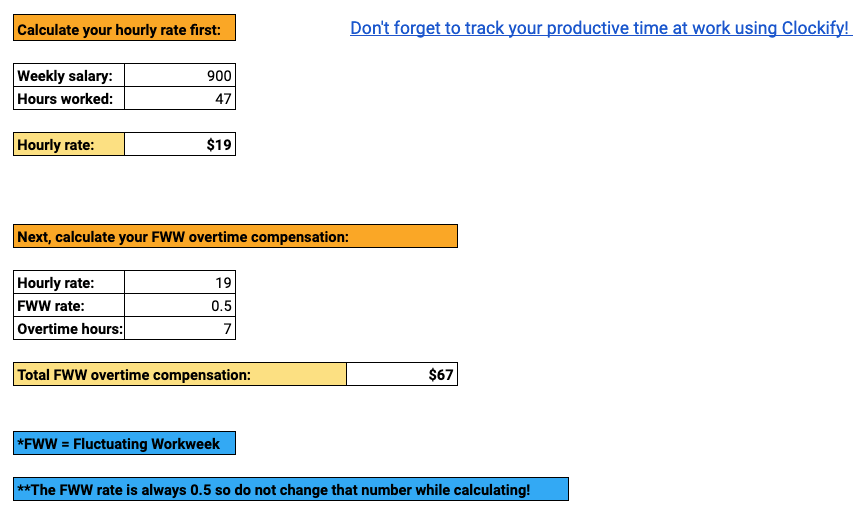

Just enter the wages tax withholdings and other information required. The first step to calculating payroll in Missouri is applying the state tax rate to each employees earnings starting at 15. Employers can use the calculator rather than manually looking up.

That tax rate hasnt changed since 1993. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Employees with multiple employers may refer to.

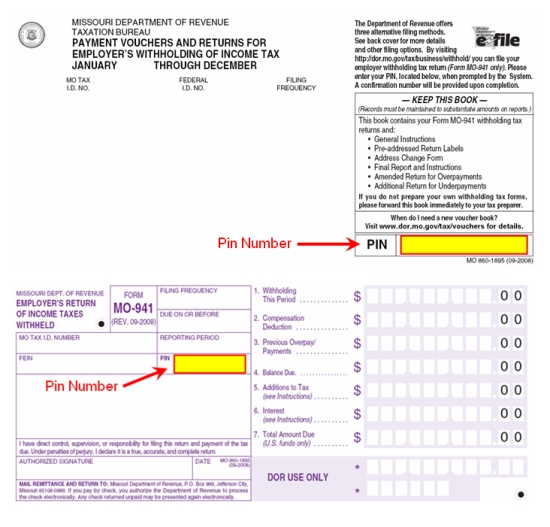

This tax is a. Missouri Cigarette Tax. If you have misplaced this identification number and are an authorized person for the account you may call 573 751-5860 to obtain.

Its a progressive income tax meaning the more money. Employers covered by the states approved UI program are required to pay 60 on wages up to 7000 per worker per year to the Federal UI. Missouri has the lowest cigarette tax of any state in the country at just 17 cents per pack of 20.

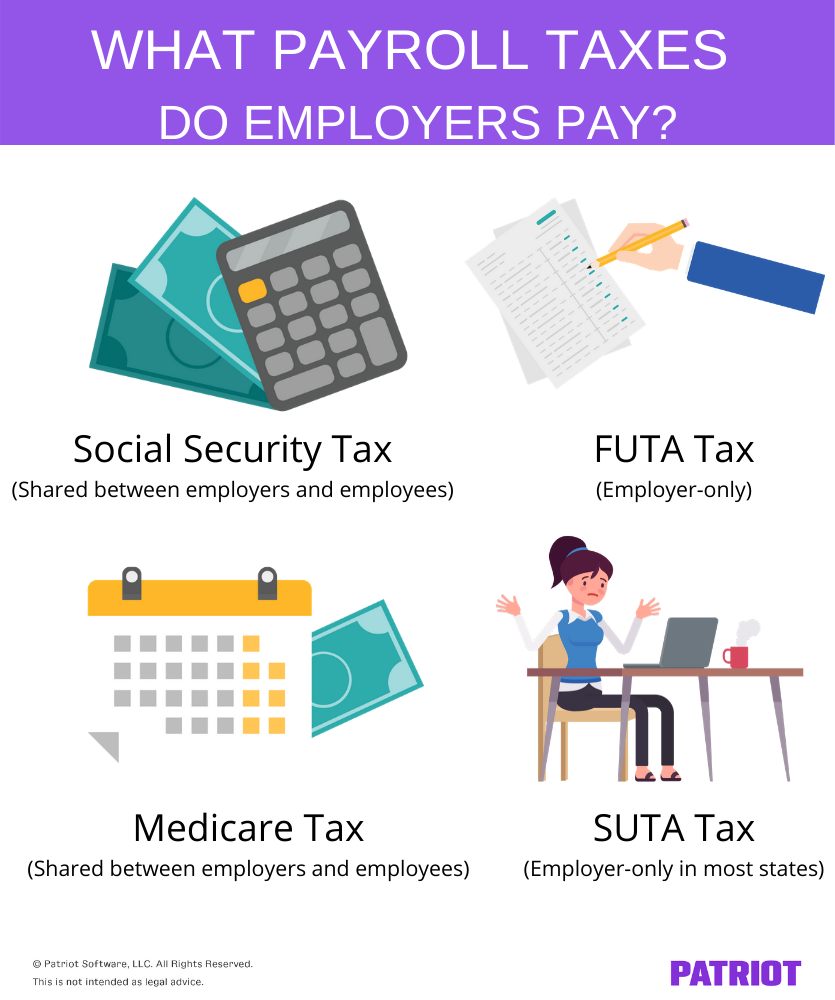

The maximum an employee will pay in 2022 is 911400. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. If you work for yourself you need to pay the self-employment tax which is equal to both the.

The standard FUTA tax rate is 6 so your max. Employers can use the calculator rather than manually looking up. Paycheck calculators Payroll tax rates Withholding forms Small business guides.

The state income tax rate in Missouri is progressive and ranges from 0 to 53 while federal income tax rates range from 10 to 37 depending on your income. Paycheck Withholding Calculator Statement of Account. So the tax year 2022 will start from July 01 2021 to June 30 2022.

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Missouri Salary Paycheck Calculator. Follow the steps on our Federal.

Employees can use the calculator to do tax planning and project future withholdings and changes to their Missouri W-4. Missouri Tax Registration Application Form 2643. Use our handy calculators linked below to assist you in determining your income tax withholding or penalties for failure to file or pay taxes.

Use ADPs Missouri Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Missouri is currently not a credit reduction state. Missouri Hourly Paycheck Calculator.

Calculate your Missouri net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and.

Withholding Tax Credit Inquiry Instructions

Employer Payroll Tax Calculator Free Online Tool By Incfile

Missouri Household Employment Tax And Labor Law Guide Care Com Homepay

Relief In Employment Tax Cases With The Irs Silver Law Plc

Missouri Wage Calculator Minimum Wage Org

Nanny Tax Payroll Calculator Gtm Payroll Services

Tax Implications Of The Employee S Income Tax Borne By The Employer Ctl Strategies

Employer Payroll Tax Calculator Free Online Tool By Incfile

![]()

Free Missouri Payroll Calculator 2022 Mo Tax Rates Onpay

Free Tax Preparation Help Available At Mizzou Show Me Mizzou University Of Missouri

Payroll Taxes Paid By Employer Overview Of Employer Liabilities

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Employees Vernon County Missouri